How are airdrops taxed?

Key takeaways

- You need to pay tax on any airdrops you claim or receive.

- You need to calculate the value of the airdrop when you receive it.

- You need to pay income tax when you first receive the airdrop, and capital gains tax if you sell it.

Airdrops are one of the biggest crypto marketing trends of recent years. They involve the giveaway of tokens to cryptocurrency users, often for free.

If you’re lucky enough to receive an airdrop then you’ll need to report your crypto airdrop as income to the IRS as part of your tax report.

In this guide, we’ll explain how airdrops are taxed in the USA, how to report your airdrop tax to the IRS, and how to use crypto tax software to make the process easier.

What is an airdrop? Find out which type you received

Airdrops are when cryptocurrency projects distribute a coin or token to cryptocurrency users as a reward or incentive. This is often used as a marketing tool to get DeFi users to interact with a new blockchain or protocol.

There are typically two ways airdrops are conducted, each with different tax implications:

-

Direct to wallet: Some airdrops will drop tokens directly to your wallet, meaning that you don’t need to do anything to claim them. It also means you get to avoid gas fees, which can be costly if claiming Ethereum airdrops.

-

Claimed by wallet: Many popular airdrops require users to claim their tokens from a website before a specified date. This means that you will need to pay the gas fees involved, and may lose your right to the airdrop if you don’t claim your tokens by the deadline.

Whether or not you had to pay gas to claim your airdrop, will affect your overall tax liability.

How are airdrops taxed in the USA?

For most people doing their taxes in the USA there are two stages involved when calculating crypto airdrop taxes. This does not mean you are taxed twice, but there are two taxable events that will add up to the total amount of tax owed on your airdrop.

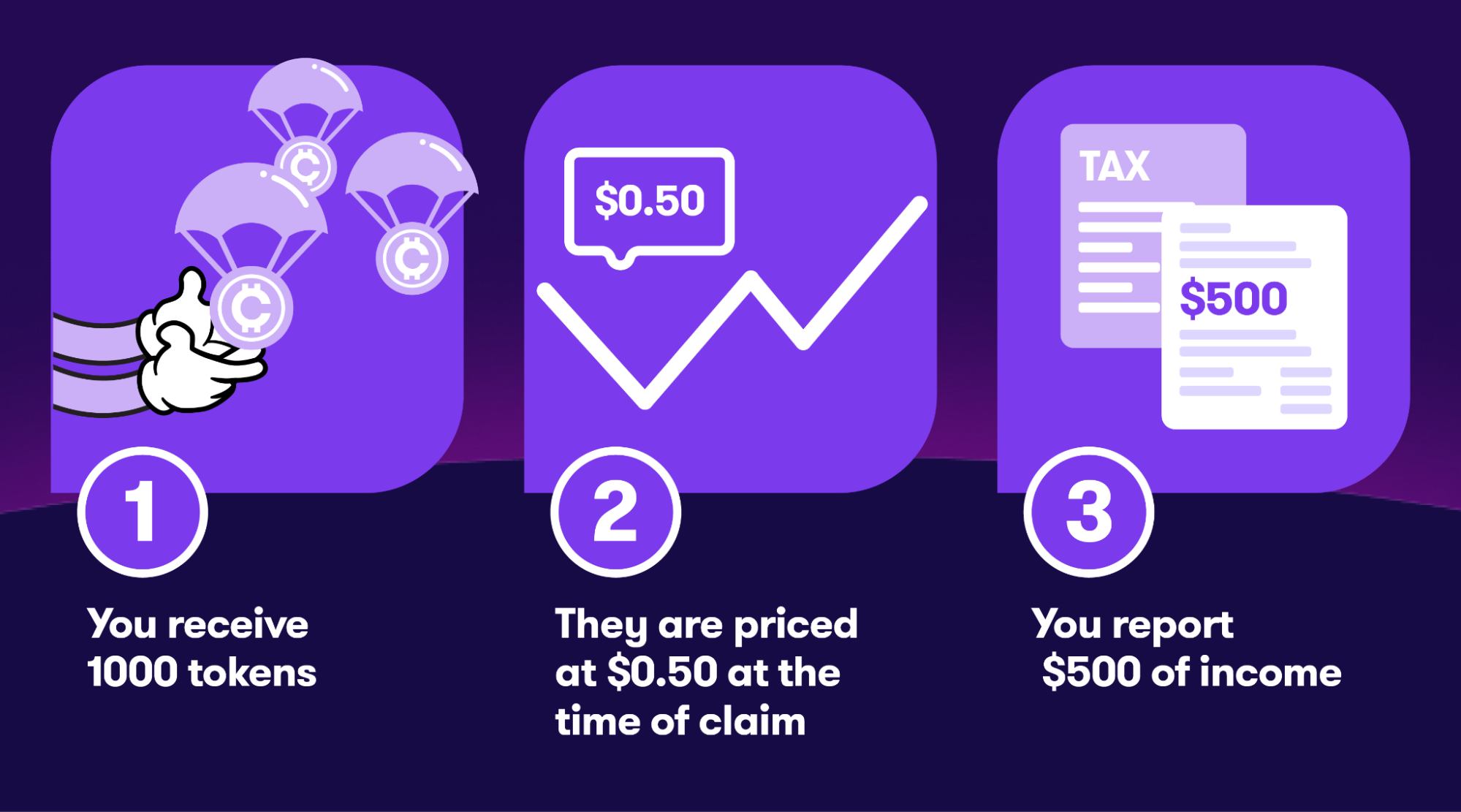

1. Calculate the value of the airdrop at the time you received it

The first stage is when you receive the airdrop.

The IRS will likely view any airdrop you receive as an "accession to wealth" which means your wealth has grown as a result of the airdrop, and you will need to report it as income at the time of receipt.

To do this you will need to calculate the fair market value of the tokens at the time and date you became the beneficial owner. This will depend on how you received your airdrop.

- Direct to wallet: If the airdrop was delivered directly into your wallet, then the fair market value is likely based on the time and date when you received it.

- Claimed by wallet: In situations where you need to claim an airdrop, the fair market value is likely based on the time and date when you had the ability to transfer or trade it.

This value will then need to be reported on your tax statement as part of your income.

Example:

Martin received an airdrop of 1000 tokens, which had a market value of $500 at the time he received them in his wallet.

This $500 becomes the cost basis for the tokens, and must be reported as income for tax purposes.

2. Calculate the capital gains received when you sell your airdrop

The second tax stage is when you sell the airdrop, dispose of it, or swap it for another asset.

When this occurs, the IRS states that you may have to pay Capital Gains Tax on these tokens, with the cost basis being the fair market value of the token when you received it.

So that means you calculate any capital gains or losses, based on the fair market value that you calculated in the first stage.

Example:

Martin sells all 1000 tokens for $750.

This creates a capital gains tax event, where the gain is $250. This is calculated by subtracting the cost basis of $500 from the proceeds of the sale ($750).

How to report airdrops on your taxes

Any income from airdrops should be reported to the IRS on your Form 1040 Schedule 1 under the “Other Income” section.

Any gains from selling an airdrop will need to be reported as part of your capital gains tax.

How do I determine the cost basis for my airdrop?

The cost basis of your airdrop is the fair market value of the airdrop when you first received it.

You can calculate this by finding the price of the coin at the time you had dominion and control over it. To make life easier, you can use Crypto Tax Calculator which automatically calculates the cost basis of airdrops for any of the wallets you’ve added to the platform.

Crypto airdrop taxes and gas fees

If you had to spend gas to claim your airdrop, then you will need to consider this in your tax calculations.

Any gas you spent claiming the airdrop will help reduce the cost basis of the tokens you receive, but there’s a catch – you may need to pay capital gains on the coins you used for gas.

So for instance if you used ETH as gas to claim your airdrop, you will need to calculate the capital gains on that ETH as though you had sold it. Alternatively, you may incur a capital loss if the gas token was worth less at the time of the transaction, than when you originally purchased it.

As you can see, this gets complicated quite fast. The good news is that Crypto Tax Calculator carefully considers this scenario and categorizes gas and airdrop transactions for you.

NFTs and airdrop taxes

The IRS currently treats NFT airdrops, and any airdrops received from holding an NFT, just like any other cryptocurrency airdrop.

This means you will need to calculate the fair market value of any airdrop rewards at the time you received them, as well as any capital gains, should you sell those rewards.

However, because NFTs are non-fungible (ie, one of a kind) you can’t just look up the price the way you would a regular cryptocurrency like BTC or ETH.

Instead, you may need to get a professional appraisal to determine their fair market value at the time of the airdrop. In turn, this is the cost basis if you later sell that NFT.

How to report airdrops in Crypto Tax Calculator

In the Crypto Tax Calculator platform, our algorithm will automatically categorize any airdrop activity and calculate the fair market value of the tokens you received.

It will also factor in any associated gas fees you spent to claim the airdrop, which may reduce your overall cost basis.

And if you choose to sell your tokens now or in the future, our calculator will also track the capital gains event.

You also have the option to remove scam airdrops, which prevents them from being included in your final tax bill.

Removing scam airdrops from your tax report

If you have uploaded a wallet and have cryptocurrencies that you don’t recognise, marked as incoming transactions, then they may be scam tokens airdropped to your wallet.

Sometimes these scam tokens will show an extremely high value, despite having an actual market value much lower.

This poses a major issue for your tax return if left unchecked. If left categorized incorrectly, these scam airdrops could potentially impact your tax outcomes substantially as their artificially high valuation could lead to an inflated income, balance or capital gains figure.

To help with this, the Crypto Tax Calculator platform will automatically detect suspected spam cryptocurrencies and filter them from your report.

If there are any spam airdrops that our filter didn’t catch, then you can easily manage those yourself.

Simply click on the category button on the transaction and change it from Airdrop to Ignore > Spam.

Common issues with airdrops and tax

Scam airdrops

Scam airdrops are an increasingly common nuisance in crypto.

These are airdrops that are dropped directly into your wallet and may attempt to impersonate another reputable token, have an artificially inflated price, or be an attempt to scam you when you sell the token.

At tax time you may want to ignore spam airdrops tokens so that they do not contribute to your tax burden.

Price drops before you sell

If you receive a token and the price drops drastically before you sell it, you may still have to pay tax on the original amount the token was valued at when you received it. This is because the IRS calculates your tax owed based on the fair market value of the tokens when you receive them.

When you sell the token, you will then need to pay any capital gains earned from the sale.

As such, you may want to consider an investment plan that takes into account your airdrop and DeFi tax obligations so you don’t get a shock at tax time. Using a crypto tax calculator can help you monitor your DeFi taxes throughout the year so you can prepare accordingly.

My airdrop is worth $0

If you receive an airdrop that has no value at all – such as spam NFTs – then you may be eligible to ignore it on your tax return, as it has not contributed to your income.

FAQs

Do you pay tax on airdrops?

Yes. If you are a US tax resident then you need to will likely need to pay tax on airdrops at two key stages.

First when you receive the airdrop. This will likely be recognised as income by the IRS and needs to be reported as such. You need to determine the fair market value of the airdrop at the time you received it.

The second stage is if you sell the airdrop. Then you have likely triggered a capital gains event and need to pay capital gains tax as a result.

You can calculate your crypto airdrop taxes easily with free software like Crypto Tax Calculator.

How are airdrops taxed in the UK?

In the UK, the HMRC has clarified that airdrops are considered ordinary income if you did something to “earn” the reward.

It is unclear exactly where this border lies, but for example, if you received UNI for trading on Uniswap, then this could potentially be classified income, since you did have to do something to receive this reward. You should talk to your accountant about your individual circumstances.

If you decide to go on to sell the assets you received through the airdrop, the cost basis will be the market value at the time of receipt.

How are airdrops taxed in Canada?

Unfortunately, the CRA has not yet clarified whether proceeds from airdrops are subject to income and/or capital gains tax. We recommend talking to a tax professional to establish whether any airdrops you received could be viewed as income by the CRA.

Although there may be uncertainty about airdrops constituting income tax, it is highly likely that any gains made thereafter by disposing of the airdrop tokens will be classified as capital gains and thus subject to Capital Gains Tax.

How are airdrops taxed in countries besides the USA?

Airdrop rewards will be taxed will depend entirely on the rules of your tax jurisdiction.

We recommend reaching out to a local tax professional to ask for their advice on how airdrops are treated for tax purposes in your region.

US Tax Guide

Unsure about your crypto tax obligations? This comprehensive guide helps you understand and file your crypto taxes in US.

Learn about US crypto taxes

DeFi Tax Guide

Have you been dabbling with DeFi? This in-depth guide breaks down the details of DeFi taxes in US so you can file with confidence.

Learn about DeFi taxes

NFT Tax Guide

Tried your hand at NFT trading? This complete guide that breaks down the details of NFT taxes in US so you can file with confidence.

Learn about NFT taxes