Key takeaways

- Crypto Tax Calculator helps Australian investors by analysing all your exchange and wallet data to generate tax reports ready for lodging with the ATO. Using software minimizes errors and makes it easier to meet your tax obligations.

- You must report all your taxable crypto transactions (trading, spending, earning, etc.) in your annual tax return. This includes activity on Australian and overseas exchanges, DeFi platforms, and NFTs.

- In Australia, cryptocurrency transactions can trigger Capital Gains Tax (CGT) or Income Tax depending on the nature of the event. Crypto is treated as property, not as currency, for tax purposes.

How is crypto taxed in Australia?

In Australia, cryptocurrency is taxed like a capital asset (e.g., shares or property), not a foreign currency.

There is no separate “crypto tax” – instead, your crypto activities are subject to either Capital Gains Tax (CGT) or income tax under the Australian tax system. How a particular crypto transaction is taxed depends on what you were doing:

-

Disposing of crypto (selling, trading, spending, gifting): This triggers a CGT event. You’ll need to calculate a capital gain or capital loss for each disposal. Profits are subject to capital gains tax, eligible for the 50% CGT discount, and losses may reduce your other capital gains.

-

Earning or receiving crypto: This is treated as ordinary income. If you receive cryptocurrency as a reward, salary, staking yield, etc., you owe income tax on the value (in AUD) of the crypto at the time you received it.

Crypto capital gains vs crypto income

It’s important to distinguish between crypto transactions that result in capital gains versus those that count as income, because they are taxed differently.

Capital gains tax events occur whenever you dispose of a cryptocurrency – that is, when you sell it, trade it, swap it, convert it, or give it away.

If the market value at disposal is more than what you paid (cost base), you have a capital gain; if it's less, you have a capital loss.

On the other hand, income tax events occur when you receive new cryptocurrency – for example, getting rewarded or paid in crypto – and those are taxed as income at the value in Australian dollars when you receive them.

| Crypto transactions taxed under CGT | Crypto transactions taxed as Income |

|---|---|

| Selling cryptocurrency for Australian dollars (or any fiat currency) | Mining cryptocurrency and receiving block rewards (income) |

| Swapping one crypto for another (coin swaps, including stablecoins) | Staking rewards, interest payments or yield farming rewards paid in crypto |

| Using crypto from your investments to purchase goods or services (spending crypto) | Airdrops of tokens that are established and have an existing market price |

| Gifting crypto to someone (you disposed of it as a gift) | Salary or business income received in crypto (e.g. getting paid in BTC) |

| Selling or trading NFTs | Referral bonuses, rewards, or any other crypto payments for services |

What if I bought crypto but didn’t sell?

Simply buying crypto with fiat (AUD) and holding it does not trigger any tax.

There’s no tax on merely holding or transferring crypto between your own wallets. Tax is only calculated when a taxable event like a disposal or income receipt happens.

How to do your crypto taxes in 5 steps

The Australian tax year runs from 1 July to 30 June, and tax returns are generally due by 31 October (if self-lodging) or later if using an agent.

If you had any cryptocurrency transactions during the financial year, you'll need to answer “Yes” to the crypto question if asked whether you had taxable crypto transactions.

Here’s how to work out your crypto taxes in Australia step-by-step:

1. Gather your transaction history

Collect records from all exchanges, brokers, wallets, and DeFi platforms you used.

- This includes dates of each trade, purchase, sale, swap, or transaction, the amounts of cryptocurrency, and the value in Australian dollars at the time.

- Include transaction fees, and what each transaction was for (e.g. “bought 0.5 ETH on Binance” or “swapped 1 BTC for ETH on Uniswap”).

- Good recordkeeping is vital; the ATO requires you to keep these details for each crypto asset.

How we can help: Crypto Tax Calculator can automatically import your trades from exchanges and wallets, analyse them, and produce an ATO-compliant tax report. No fuss, no headaches.

2. Calculate your capital gains and losses

For each disposal of cryptocurrency, work out the capital gain or capital loss:

- Capital Gain/loss = Proceeds (value you received in AUD) – Cost Base (what you originally paid, plus any fees).

Do this for every sale, trade, or coin swap. Make sure to convert any crypto-to-crypto trades into AUD values at the time of the transaction.

Apply the 50% capital gains tax discount to any assets that were held for 12 months or more before being sold.

3. Offset your losses against your gains

Once you have all gains and losses, offset your losses against your gains.

In Australia, capital losses can only be used to reduce capital gains (not other income). This applies to all your capital assets which are pooled together for the purpose of netting out gains and losses.

For example, if you made a $5,000 gain on one crypto and had a $3,000 loss on a stock, your net capital gain is $2,000.

If your losses exceed your gains for the year, you will have no taxable capital gains, and you can carry forward the unused capital loss to future years.

The net capital gain (after losses and discounts) is the amount that will be added to your taxable income.

4. Report crypto income

Next, total up any crypto income you earned during the year outside of capital gains.

This includes things like staking rewards, income-tax applicable airdrops, referral or airdrop bonuses, crypto earned from DeFi interest, salary or freelance payments received in crypto, etc.

Use the AUD value at the time you received each amount. You should report these amounts as part of your income.

For most individuals, crypto income can be declared in the “Other Income” section of your tax return (with a description like “cryptocurrency earnings”), or under business income if you have an ongoing crypto business. The key is that it gets included in your assessable income for the year.

5. Lodge your tax return

Finally, include the above calculations in your tax return for the relevant financial year.

If using myTax (the ATO’s online lodgement), you’ll need to:

- Indicate that you had capital gains or losses (there’s a question about disposals of assets like crypto).

- Fill in the net capital gain amount (the ATO form will also ask for total gains and total losses you carried forward or used).

- Include any crypto income in the appropriate section.

If you use a tax agent or accountant, provide them with the details or a report of your crypto gains and income so they can include it.

Read our dedicated step-by-step guide on reporting crypto with myTax to make your life easier at tax time this year.

Use Crypto Tax Calculator and save yourself the hassle at tax time. Get your taxes done in just a few clicks, instead of days, and receive a compliant tax report ready for the ATO or your tax agent.

4.8/5 TrustPilot

How much tax do you pay on crypto in Australia?

A common question is “What is the tax rate on crypto gains in Australia?”

The answer depends on your income and how long you held the asset.

Cryptocurrency gains are treated just like other investment gains (for example, gains from shares or property).

They do not have a fixed tax rate – instead, any net capital gains you make are added to your taxable income for the year, and you pay tax at your marginal income tax rate.

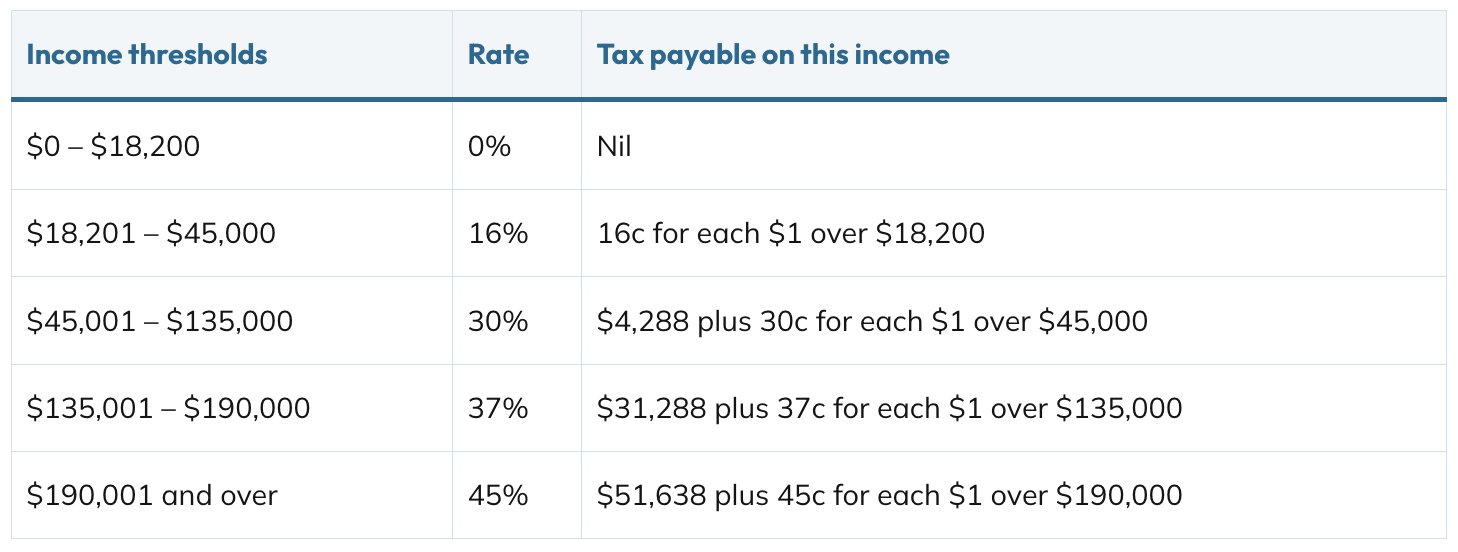

Australian income tax rates for individuals in 2024-25 and 2025-26

Source: Super Guide

Source: Super Guide

How to find your tax bracket

Australia has a progressive income tax system with tax brackets.

For both the 2024-25 and 2025-26 tax years, rates for individuals range roughly from 0% (for low incomes under $18,200) up to 45% for incomes over $180,000 (excluding Medicare Levy).

Your crypto gains will push your income higher, so effectively you pay whatever marginal rate applies to that portion of your income. In practical terms, crypto profits can be taxed anywhere from 0% up to about 47% (45% top rate + 2% Medicare) depending on your total income.

Long-term capital gains tax discount

The good news for Australian crypto investors is that the ATO offers a Capital Gains Tax Discount for long-term holdings.

If you hold a cryptocurrency investment for 12 months or more before disposing of it, you get a 50% CGT discount if you are an individual taxpayer. This means you only include half of the profit in your taxable income.

In effect, a long-term crypto investment is taxed at half your marginal rate. By contrast, if you held the asset for less than 12 months, no discount applies – 100% of the gain is taxed at your marginal rate.

Let’s illustrate with a simple example:

Short-term scenario:

You bought 1 Bitcoin for $30,000 and sold it 6 months later for $40,000. Your capital gain is $10,000.

Your regular income is $50,000, which gives you a total income of $60,000 for the year, once the Bitcoin gain is added in.

This puts you in the 30% tax bracket, meaning that $10,000 gain will be taxed at 30%, resulting in $3,000 tax on the crypto gain (plus Medicare levy if applicable).

Long-term scenario:

Instead, suppose you held that Bitcoin for 18 months before selling at the same $10,000 profit. Now you qualify for the 50% CGT discount. Only $5,000 of the gain is added to your income.

At a 30% rate, the tax on the gain would be about $1,500. You saved roughly $1,500 by holding long term. In other words, the effective tax rate on the gain became ~15% instead of 30%.

As you can see, holding cryptocurrency for over a year can significantly reduce the tax you pay on your profits. This is a key tax planning point for crypto investors in Australia (more on strategies to reduce tax later). Keep in mind the CGT discount is generally available to individuals, trusts, and SMSFs – but not companies. Companies pay the full rate on gains with no discount.

Using losses to offset gains

What about losses? If you sold crypto at a loss, that can reduce your tax, but not against your salary.

**Capital losses** can only be used to offset capital gains, not other income. If losses exceed gains in a financial year, then they can be carried forward to offset gains in future years.

Example:

If you had a $5,000 crypto loss and $3000 of gains, your losses would cancel out your gains for the financial year, and you wouldn’t have any capital gains tax to report. The remaining $2000 would be carried forward, and could be used to reduce your capital gains tax the following year.

Capital losses in Australia can be carried forward indefinitely until you can use them.

How to calculate your crypto capital gains tax in Australia step-by-step

Capital gains tax events in crypto

Whenever you dispose of cryptocurrency, a capital gains tax (CGT) event is triggered.

“Disposal” doesn’t only mean selling for cash – it covers a range of actions where you stop owning one crypto asset in exchange for something else.

In Australia this includes a wide range of taxable DeFi activities that often surprise investors – such as adding liquidity to a pool, or bridging crypto between chains.

Whether or not you agree with the ATO definitions of disposals, you’ll still need to calculate the proceeds from these transactions when calculating your tax.

How is selling crypto for AUD taxed?

When you sell cryptocurrency for fiat currency (eg, AUD), you must report any capital gain or loss resulting from the sale.

The capital gain/loss is the proceeds minus the cost base and any fees.

How are crypto-to-crypto swaps taxed?

Trading one crypto for another is considered a disposal of the original asset, resulting in a taxable event. You must calculate the fair-market-value of the asset received in AUD and use that as the proceeds. The capital gain/loss is the proceeds minus the cost base and any fees.

How is selling rewards from airdrops and staking taxed?

When you sell tokens that you received from staking or an airdrop, you have to pay capital gains tax on the proceeds. The proceeds are the difference between the cost base and the amount you sold it for. The cost base is the fair-market-value (FMV) of the asset when you first received it (ie, received the airdrop or staking reward into your wallet).

How is selling NFTs taxed?

Selling NFTs is a CGT event. The gain or loss is based on the difference between your cost base and the sale price in AUD.

How are deposits or withdrawals from liquidity pools taxed?

When you interact with DeFi protocols, you often exchange one cryptocurrency for another or for a token representing your stake. This is generally considered a disposal, which the ATO may consider a CGT event.

Income tax events in crypto

Not all taxable events in crypto involve disposing of an asset for a profit. Some events are taxable because you are receiving new cryptocurrency as income.

In these cases, the crypto you receive is counted as assessable income at the time you receive it.

Here are common crypto income events and how they are handled:

How are staking rewards taxed?

Rewards earned through staking are taxed as income based on the market value (in AUD) at the time you received them.

How are token rewards taxed?

You need to declare any token rewards you receive as income. These may include rewards from providing liquidity, DeFi incentives, lending crypto and referral bonuses.

Tokens are taxed as income based on the market value (in AUD) at the time you received them.

How are airdrops taxed?

Tokens earned via [airdrops are only taxable as income] when they are part of a secondary or follow-up distribution, when the price of the token has already been established.

Tokens from an initial airdrop, where the token value has not yet been established, are not subject to income tax when received.

Airdropped tokens subject to income tax are based on the market value (in AUD) of the token at the time you receive control over it. CGT applies when later sold.

How is getting payed in crypto taxed?

Crypto received as payment is taxed as income, based on the market value (in AUD) at the time you received payment.

How are hard forks taxed?

Crypto received from a hard fork is taxed as income based on the market value (in AUD) at the time you received control over the forked crypto.

Calculate your crypto capital gains and income in just a few clicks

1

Select country

2

Connect accounts

3

Get tax report

No credit card required

How to work out if you are a crypto investor vs. a trader for tax purposes

In Australia, the distinction between being a crypto investor versus a crypto trader (running a trading business) is important because it changes how your crypto is taxed.

For most people who dabble in crypto, any profits are treated as capital gains (investment income). In practice, most individuals are considered investors for tax.

However, in some cases a person’s crypto activities might constitute a business.

Here’s how the ATO classifies each:

-

Crypto investor: This is someone who buys and sells crypto as an investment, even if somewhat actively. Investors are subject to CGT on profits – meaning you get the 50% CGT discount for long-term holds, and losses can only offset capital gains (not regular income). Investors do not declare the cost of buying crypto as an immediate deduction; instead it forms part of your cost base for CGT. Most individual Australians who trade crypto on the side or as a hobby fall into this category.

-

Crypto trader: This is someone considered to be “carrying on a business” of crypto trading. If you are a trader in this sense, your profits are assessed as ordinary income (trading profit) rather than capital gains. Your crypto is viewed like inventory (trading stock). You don’t get the CGT discount, but on the flip side you can deduct crypto trading expenses in full and offset losses against other income (since it’s business income). Traders may also need to account for inventory (unsold crypto) at year-end at cost or market.

So, how do you know which one you are?

Essentially, you’re a trader if your activities are sufficiently commercial, frequent, and profit-seeking to amount to a business. Some factors the ATO consider, include:

-

Purpose and intention: Are you intending to make regular income from trading activity? An investor might hope for profit, but a trader typically has a deliberate profit-making plan (for example, short-term buying and selling for income rather than long-term appreciation). Simply intending to profit isn’t enough alone, but it’s one factor.

-

Repetition, volume, and frequency: How often do you trade? A business usually involves repeated, continuous activity. If you’re placing trades daily or weekly, and clocking a high volume of transactions, you lean more toward being a trader. An investor might only make a few trades a year or occasionally rebalance. If you have high-frequency trading akin to day trading, that suggests a trading business.

-

Organisation and business-like operations: Are you keeping detailed records of trades, doing analysis, possibly using a designated work space or tools, maybe even having an ABN for your trading? Do you have a business plan or strategy for your crypto trading? Running it in a business-like manner (for example, studying market trends, maintaining spreadsheets, using professional trading tools, having a separate bank or exchange account for trading) points to being a trader.

-

Capital and scale: The amount of capital and money invested can matter. Running a $1000 crypto portfolio is less likely a “business” than actively managing a $500,000 portfolio. Likewise, if crypto trading is your primary source of income or you’ve quit your day job to trade, that leans toward a business assessment.

How to report your crypto capital gains and income on your tax return

Lodgment dates

If you have engaged in any form of crypto asset activity, you will most likely have to declare this activity in your income tax return.

The financial year in Australia runs between 1 July and 30 June the following year.

If you are an Australian resident individual, you must submit your income tax return before 31 October 2025, for the 2024-25 tax year.

If you have a tax agent who submits income tax returns on your behalf, they must follow the appropriate lodgment date pursuant Tax Agent Lodgment Program which can be as late at May 2026.

Lodging your tax return online

You can declare your crypto asset activities in your income tax return in the same way that you would your normal income, capital gains and/or losses.

Read our dedicated step-by-step guide for a detailed walkthrough of lodging with myTax, or keep reading for a brief summary.

-

If this is your first time lodging, you will have to sign into your myGov account and link your account with the ATO.

-

Once you have linked your account, your myGov Dashboard should include the ATO under ‘Your services’:

You can access the services necessary to lodge your income tax return by selecting ‘Australian Taxation Office’ from your Dashboard. Once on the ATO website, select ‘Tax’ from the navigation bar and then select ‘Income Tax’ under the Lodgments option as below.

-

Once you have done this, select the current year’s income tax return lodgment and follow Step 1 and Step 2 to ensure your personal and bank account details are accurate. When you reach Step 3, make the following selection in addition to your regular income to ensure that your tax return reflects your crypto asset activity.

-

You can then proceed to Step 4 to prepare your tax return.

Calculating your crypto taxes with Crypto Tax Calculator

If you have undertaken more than one crypto transaction over the course of the financial year, you may find it is incredibly difficult to manually calculate your taxes. But don’t worry, you are not alone. This is an issue faced by many crypto users, and accountants continue to struggle handling the compliance burden that comes with trading in crypto. Luckily, we have made it simple to import all your crypto asset activity into one place to generate a tax report.

With our software, you can either:

(a) copy and paste your public wallet addresses into our application, or (b) use our wide range of API and/or CSV integrations.

Once you have done this, CryptoTaxCalculator auto-categorises your transactions into activity types. For example: You paste your public wallet addresses into our application. Our application recognises that you have received an airdrop. This transaction is categorised into the ‘Airdrop’ activity type. As a result, this transaction is recognised in your final tax report as income or not depending on the airdrop type itself – more on airdrops below.

If you need to make amendments, you can manually select the activity types that are relevant to the data you imported. Our application includes many categories, such as:

- Buys

- Sells

- Staking rewards

- Chain split

- Airdrops

- Mints

This allows CryptoTaxCalculator to produce a complete tax report for any financial year, personalised to meet your Australian tax requirements.

You can import data for all crypto assets you trade. CryptoTaxCalculator will combine them into various report formats. Our most frequently used format is ‘Report Summary’, where you can view your income and/or capital gains and losses for a particular financial year. Other options include ‘Income Report’, ‘Miscellaneous Expenses Report’ and more.

For more information on the different types of crypto asset activities and their taxation, we have summarised and provided examples below further to existing ATO guidance.

How can I reduce my crypto tax in Australia?

Legally reducing (or optimising) your crypto taxes in Australia largely comes down to smart planning and taking advantage of available rules. Here are several strategies and considerations to legally minimise the tax you owe on cryptocurrency:

1. Hold long term (12+ months)

As discussed, if you hold your crypto investment for at least 12 months before selling, you qualify for a 50% CGT discount on the gain.

This instantly cuts your taxable gain in half, which can save you a lot. For example, instead of paying tax on a $10,000 gain, you’d only pay tax on $5,000.

This benefits investors who are not frequently trading. This isn’t always possible in the volatile crypto market, but it’s a significant incentive to avoid quick flips with large portions of your portfolio.

2. Harvest losses to offset gains

If some of your crypto investments are down, selling them before the end of the financial year can crystallise capital losses which you can use to offset other capital gains.

This is known as tax-loss harvesting.

For instance, say you have $5,000 profit from Bitcoin, but you’re down $3,000 on some altcoins.If you sell the altcoins and realise that $3k loss, you can subtract it from the $5k gain – meaning you’ll only be taxed on $2k instead of $5k. By doing this before June 30, you reduce that year’s taxable gains.

Remember, you can’t claim a net capital loss against your salary, but you can use it to offset other gains fully. Any leftover losses carry forward.

Caution: The ATO frowns on “wash sales”, which are sales done purely for a tax loss followed by immediate repurchase of the same asset. Don’t sell a coin at a loss on June 29 and buy it back on July 1 just to claim the loss – that could be seen as tax avoidance. But if you genuinely want to exit a losing position or switch to a different investment, doing so by year-end to use the loss is fine.

3. Use specific identification of assets

If you have multiple tranches of a cryptocurrency (bought at different times/prices), you have some flexibility in choosing which units you are selling for tax purposes, as long as you have records.

By specifically identifying the coins you sell, you can choose the ones with the highest cost base to minimise gains.

For example, you bought 1 ETH at $2k and another at $4k on different dates. If you sell 1 ETH at $5k, you’d rather claim you sold the one that cost $4k (so gain = $1k) than the one that cost $2k (gain = $3k).

The ATO permits specific identification as long as you can prove which is which (e.g., via wallet addresses or detailed exchange records) and keep detailed records, which remain consistent between tax years. If you cannot specifically identify which assets you sold, the default is FIFO (first in, first out).

Crypto Tax Calculator lets you choose accounting methods like FIFO, LIFO, HIFO or Most Tax Effective. Check what method gives you the lowest overall gain – just be consistent and keep the supporting records of your choice.

4. Invest via a super fund (SMSF)

For those with significant amounts of crypto or who are serious long-term investors, using a self-managed superannuation fund (SMSF) to invest in crypto can be tax-efficient.

Super funds in Australia pay a concessional tax rate of 15% on investment earnings and a one-third discount on capital gains if held for more than 12 months. This is much lower than the top personal rate of 45%.

If your SMSF’s trust deed allows crypto investment and you comply with the strict regulations (sole purpose test, separation of assets, etc.), the SMSF can buy and HODL crypto.

Any gains it realises are taxed at 15% (or 10% discounted) instead of your possibly higher rate.

Also, if you hold until retirement/pension phase, future gains might even be tax-free (since super in pension mode can be 0% tax on earnings up to certain limits).

Caution: Running an SMSF is a lot of responsibility and there are high ongoing costs involved. If you’re interested, seek professional advice to set it up correctly.

5. Keep good records and use tax tools

By maintaining accurate records of every transaction, you ensure you claim all possible costs (like transaction fees, purchase prices, etc.) which increase cost bases or reduce gains.

People often forget the small fees or costs that could reduce their tax, even though these can be quite substantial, especially when considering gas fees on the Ethereum or Bitcoin networks.

Crypto Tax Calculator will automatically factor fees and deductions in to your tax report, and you can choose to apply the optimal accounting method from the options available. It also helps reduce errors that could lead to overpaying on your tax. Being organised helps if you are ever audited, or need to provide proof of your transaction history to the ATO.

6. Consult a tax professional

If you have a large portfolio, consulting a tax professional like an accountant may help you optimise your tax. They might identify opportunities specific to your case, or explain how to use financial arrangements such as trusts, to minimise your tax.

Never evade taxes. Any scheme that sounds too good to be true likely is, and can land you in serious trouble. The ATO has a wide net and can apply anti-avoidance rules if you do something solely to avoid tax. The strategies above are all normal tax planning strategies, simply applied to cryptocurrency.

Is cryptocurrency legal in Australia?

Yes – cryptocurrency is legal in Australia.

There are no laws prohibiting individuals from buying, selling, or holding cryptocurrencies. In fact, Australia was one of the early adopters of crypto-friendly regulations. The Australian government and regulators have taken a relatively positive, if cautious, stance toward crypto. They recognise crypto assets as legitimate property and investment products (though not as “money” or legal tender).

Australians can freely use crypto exchanges and own digital assets, provided they comply with relevant laws (primarily tax and anti-money laundering laws). Since 2017, crypto transactions have been explicitly legal and Australia updated its laws to ensure, for example, that you don’t pay Goods and Services Tax (GST) twice on crypto trades (initially crypto was treated in a way that caused double taxation, which was fixed).

The government has also stated it does not oppose citizens investing in crypto, but it does remind people that crypto can be volatile and risky.

While crypto is legal, it is regulated in certain ways:

-

Taxation: The ATO oversees taxation of cryptocurrency. As this guide explains, you are required to report crypto gains and income on your taxes. The government’s stance is essentially “it’s legal to invest, but you must pay your taxes on it.” In fact, the ATO has issued warnings to taxpayers to ensure they disclose crypto capital gains.

-

Exchanges and AML: Cryptocurrency exchanges and trading platforms in Australia must register with AUSTRAC (the financial crime regulator) and comply with Anti-Money Laundering and Counter-Terrorism Financing (AML/CTF) regulations. This means Australian exchanges typically require user identification (KYC), report suspicious activities and share data with the ATO. This regulatory framework, in place since 2018, legitimises crypto businesses and helps prevent misuse of crypto for illicit purposes.

-

Financial regulation: The Australian Securities and Investments Commission (ASIC) provides guidance for crypto businesses, especially those offering investment products. There are guidelines on initial coin offerings (ICOs), managed investment schemes involving crypto, etc., to protect consumers. Currently, there isn’t a comprehensive licensing regime for general crypto trading of non-securities, but the government has been reviewing crypto asset regulation to possibly implement stricter rules in the future.

-

Legal tender status: Crypto is not legal tender in Australia. Only Australian dollars (issued by the Reserve Bank of Australia) have that status. Businesses are not obliged to accept crypto as payment (though some do by choice). Crypto is treated as property or a digital asset in the eyes of the law.

Can the ATO track crypto?

One big myth about crypto is that it’s “anonymous” and invisible to authorities. In reality, the ATO can and does track cryptocurrency transactions, especially those involving Australian residents.

The ATO has implemented a crypto assets data-matching program since 2019 (extended through 2025-26). Under this program, the ATO obtains data from cryptocurrency exchanges, trading platforms, and brokers (referred to as “designated service providers”) and matches it with individuals’ tax records.

Here’s how the ATO is able to track your crypto:

-

Exchange data sharing: Most Australian-based crypto exchanges are providing transaction data to the ATO. This includes information like your name, address, trading account details, transaction dates, coin types, and transaction values. If you have an account on a registered exchange, assume that the ATO knows about your holdings and trades. In fact, data from hundreds of thousands of Australians’ crypto transactions have been reported. The ATO uses this data to identify people who are not reporting their crypto gains. They have stated that they will prompt or contact taxpayers who don’t properly report crypto on their tax return.

-

Data matching & audits: The ATO’s data-matching compares your tax return with the information gathered from exchanges and other sources. If, for example, an exchange reports that you sold $50,000 worth of cryptocurrency in the year, but your tax return shows no capital gains, this discrepancy is flagged. The ATO might then send you a letter or amend your return. Repeated or major omissions could trigger a formal audit and penalties. Simply put, if you try to hide crypto income, you are taking a serious risk. The ATO has explicitly warned that undeclared crypto gains will be detected and can result in back taxes, fines, or worse.

-

Overseas exchanges & blockchain analysis: Even if you trade on overseas platforms, you are not invisible. The ATO participates in international data-sharing networks (through treaties and the Joint Chiefs of Global Tax Enforcement) that share financial data across borders. Also, many major exchanges overseas issue tax reports or have agreements to share data for tax purposes. Additionally, the ATO can use blockchain analytics tools to trace transactions on public ledgers. Every crypto trade leaves a digital footprint. Sophisticated analysis can sometimes link wallet addresses to individuals, especially if you ever cashed out to a bank or used an exchange that did KYC.

-

Bank transfers and fiat on/off ramps: If you’ve moved money between your Australian bank account and crypto platforms, those bank transactions themselves can be a giveaway. Banks report large or suspicious transactions. The ATO could notice if, say, tens of thousands of dollars flowed to a known crypto exchange and no corresponding income was reported.

Record Keeping for Cryptocurrency

ATO Data Matching Protocol

The ATO has announced the continuation of its crypto asset data matching protocol for the 2023/24 financial year through to the 2025/26 financial year. As part of this protocol, the ATO acquires account identification and transaction data from Australian digital currency exchanges (DCEs) and links that information with ATO systems.

This means that the ATO acquires crypto records relating to approximately 1.2 million Australian taxpayers and, using a specialised matching process, identifies whether users are meeting their tax obligations. Despite what you may hear through public forums, the ATO is aware of your crypto asset transactions.

Therefore, if you are an Australian resident engaging in crypto asset transactions, it is critical that you meet your tax obligations. While identifying the tax treatment of crypto assets and preparing the necessary records may be difficult, CryptoTaxCalculator can help you streamline this process to make the complicated process of declaring your crypto asset activities with tax regulators easier.

Keeping Records

It is critical that you maintain records of all your crypto asset activities. Records may be requested at the discretion of the ATO and generally need to be held for a period of 5 years after the crypto asset activity.

The records you maintain must include the following:

- the date of the transactions

- the value of the cryptocurrency in Australian dollars at the time of the transaction (which can be taken from a reputable online exchange)

- what the transaction was for and who the other party was (even if it’s just their cryptocurrency address).

In addition to the above requirements, you should keep records of:

- receipts when you buy, transfer or dispose of crypto assets

- a record of the date of each transaction

- a record of what the transaction is for and who the other party is

- exchange records

- a record of the value of the crypto asset in Australian dollars at the time of each transaction

- records of agent, accountant and legal costs

- digital wallet records and keys

- a record of software costs that relate to managing your tax affairs.

If you routinely engage in crypto asset transactions, this can be a tedious process. Crypto Tax Calculator offers a range of functions to help streamline the record-keeping process for you, by helping handle importing and categorising your data automatically.

How can Crypto Tax Calculator help?

Crypto Tax Calculator wants to make the complicated process of declaring your crypto asset activities with tax regulators easier. From decentralised exchanges to non-fungible tokens, we are one of the most integrated crypto tax software products on the market. If you are not already taking advantage of crypto tax software, try it today for free. We also offer a 30-day money back guarantee on all purchases.

4.8/5 TrustPilot

James Edwards has been active in the cryptocurrency industry for over 10 years. He is an avid user of DeFi and believes in the promise of a user-owned and operated web.

His expertise as a cryptocurrency journalist has seen him contribute to publications such as Nasdaq, CoinMarketCap and CoinTelegraph.