USA Crypto Tax Guide 2025

Key takeaways

- Cryptocurrency is subject to both Capital Gains Tax and Income Tax, depending on the nature of the transaction.

- You need to report all of your crypto trading activity on your annual tax return, including overseas exchanges and DeFi.

- You can use software like Crypto Tax Calculator to easily create a tax report for you, ready to submit to the IRS.

In this guide you will learn everything you need to know about how cryptocurrency is taxed in the US.

It includes practical steps for you to take so that you can get your crypto tax sorted.

You'll find plenty of examples demonstrating how various tax rules work, and for those of you that are visual learners, you'll find videos and infographics summarising each section.

Read on to start with the basics of how crypto is taxed by the IRS, or skip ahead to one of the following sections if you're after something specific:

- How crypto is taxed in the US

- How to calculate capital gains tax on crypto

- Capital gains tax events in crypto

- Income Tax events in crypto

- How to lower crypto gains with losses

- Changes to crypto tax in 2025

- Tax forms you need for crypto

- How to lower your crypto taxes

- Misconceptions about crypto tax

- Key dates for tax reporting

- What to do if you forgot to report crypto on your taxes

Why you can trust this guide

There is no one clear rule that says how every single one of your cryptocurrency transactions should be taxed. Instead, the IRS periodically releases guidelines to help you understand your obligations.

Our Head of Tax, Nick Waytula, reviewed these guidelines to help produce this comprehensive guide to crypto taxes in the US, alongside our expert writing team.

How is cryptocurrency taxed?

In the US cryptocurrency is taxed like property, not currency. This means that it is often taxed like stocks, bonds, and other capital gains assets.

How you use your cryptocurrency will also affect how it is taxed.

- If you are trading or selling your crypto, it will be subject to capital gains tax.

- If you receive crypto as a payment for something, it will be taxed as income tax.

The difference between capital gains and income

When dealing with cryptocurrency, it’s the first thing to do is to distinguish between transactions taxed as capital gains and those taxed as other income or ordinary income:

- Capital Gains: If you sell, trade, or exchange cryptocurrency, the profits (or losses) are treated as capital gains. The tax rate depends on how long you held the asset before disposing of it.

- Income: Receiving cryptocurrency as payment for goods, services, mining, staking rewards, or airdrops is taxed as other income or ordinary income at your marginal tax rate. This includes the fair market value of the crypto in US dollars at the time of receipt.

| Capital Gains Tax Events | Income Tax Events |

|---|---|

| Selling one crypto for another (eg, trading BTC for ETH) | Mining |

| Selling crypto for US dollars | Staking rewards and yield farming |

| Purchasing items with cryptocurrency | Airdrops |

| Selling NFTs | Forks |

| Buying NFTs with crypto | Buying NFTs with crypto |

How to calculate capital gains tax on crypto

When you sell or exchange cryptocurrency, the gain or loss is calculated based on how long you held the asset and whether the transaction qualifies as a short-term or long-term capital gain.

To determine how long you have held your cryptocurrency is quite simple; the IRS considers the holding period to start the day after you acquired the currency and ends on the day you dispose of your virtual currency.

Let’s look at how the holding period will affect how much tax you have to pay.

Short-term capital gains: If you have held your crypto for less than a year

Cryptocurrency held for 1 year or less before being sold or exchanged is subject to short-term capital gains tax.

These gains are taxed at your ordinary income tax rate, which can range from 10% to 37%, depending on your total taxable income.

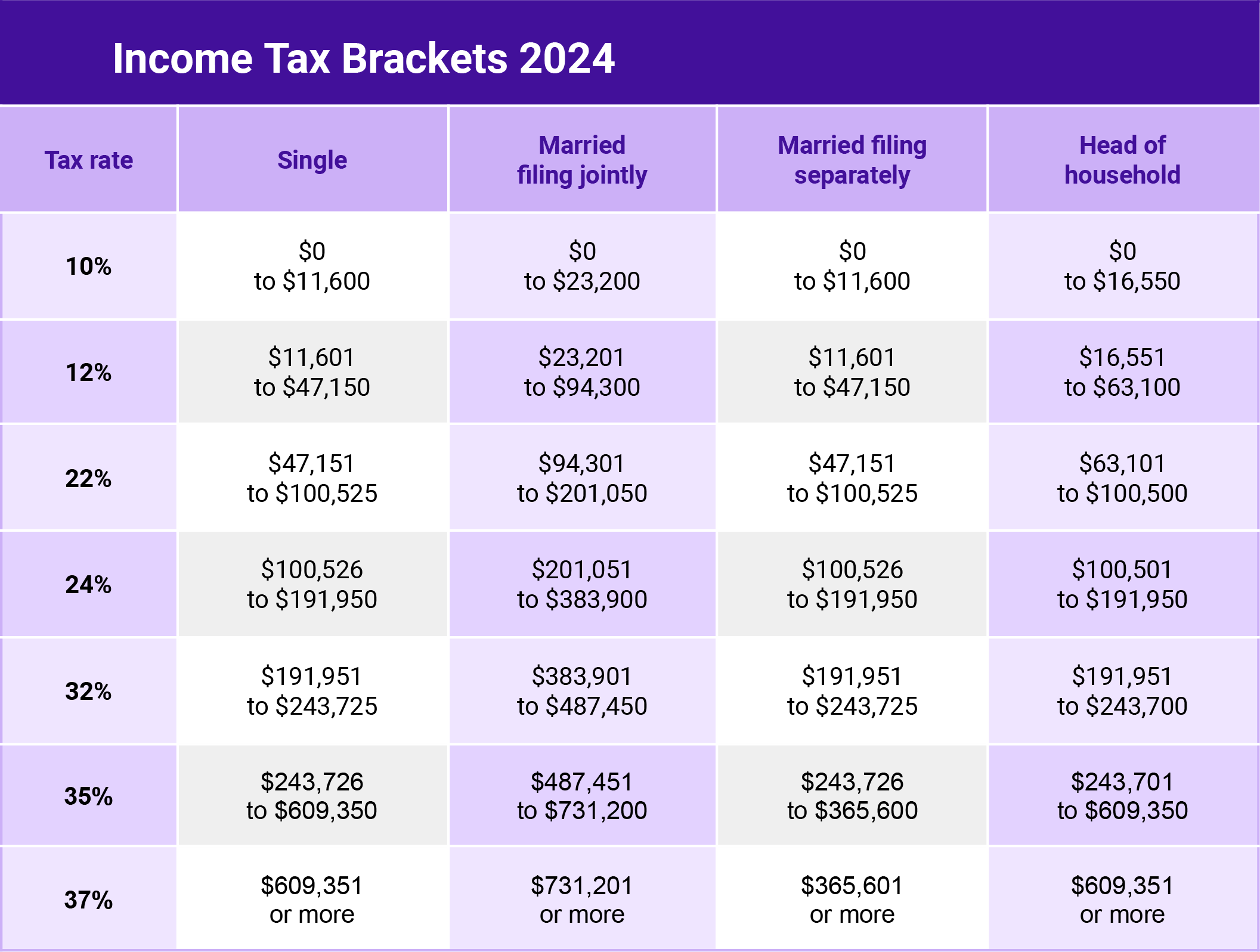

Income tax brackets for the 2024 tax-year. These are what you use to calculate your tax when you lodge in 2025.

Note that your capital gains amount is added to your income, and you are then taxed according to the bracket you fall in.

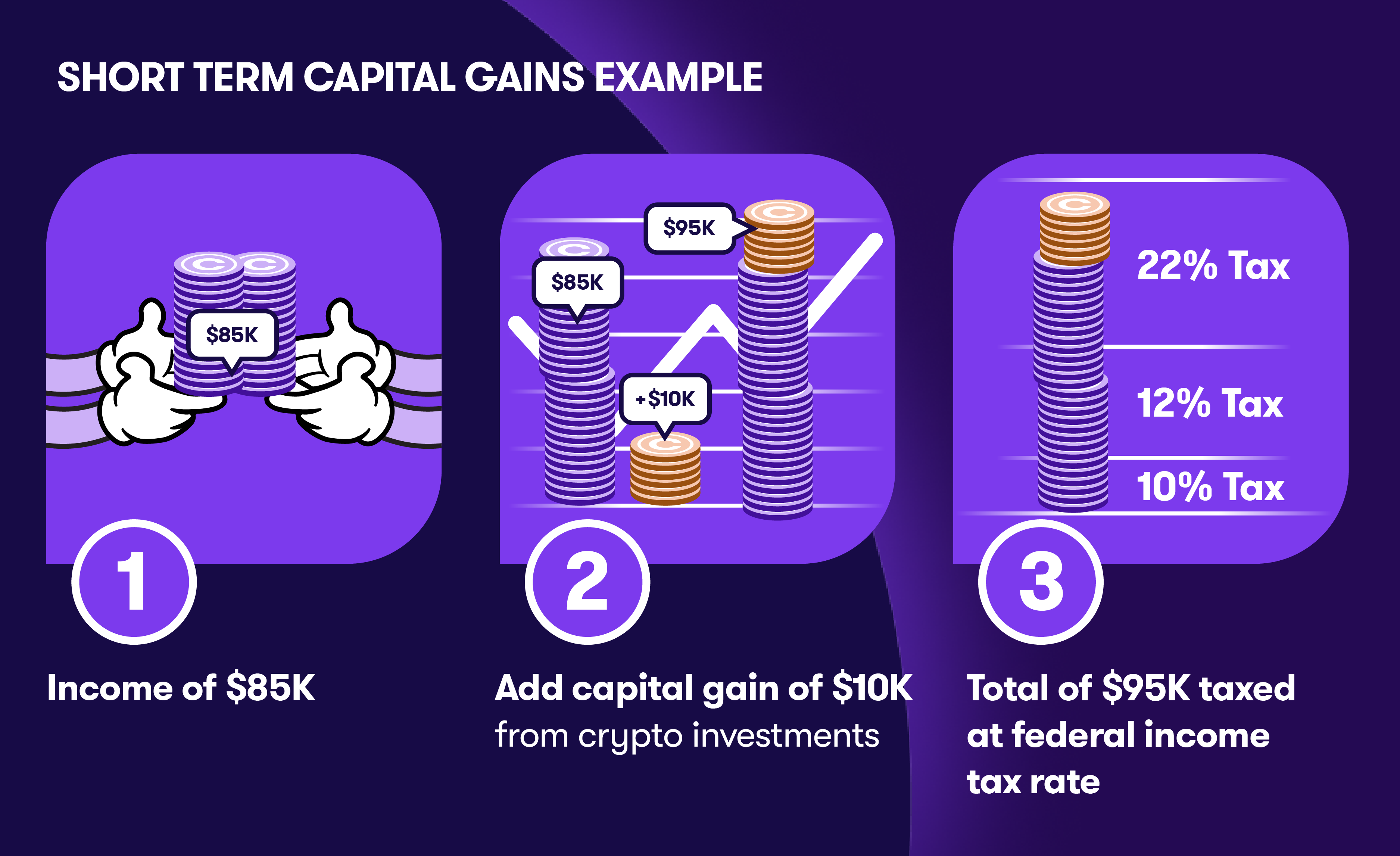

Example: Calculating tax on a short-term capital gain

Step 1: Calculate your capital gain

- You purchase 1 BTC in June 2024 for $70,000.

- 4 months later, you decide to sell your 1 BTC for $80,000.

- The capital gain is $80,000 - $70,000 = $10,000.

Step 2: Calculate your total income

- Your income from your job is $85,000.

- Your total income including the capital gain is $85,000 + $10,000 = $95,000.

Step 3: Calculate tax using progressive tax brackets

Using the 2024 Federal Income Tax brackets, here’s how your total income of $95,000 is taxed:

- $11,600 of your total income is taxed at 10%.

- $35,550 of your income is taxed at 12% ($47,150 - $11,600).

- $47,850 of your income is taxed at 22% ($95,000 - $47,150). This includes your entire $10,000 capital gain.

Therefore, the tax on your $10,000 capital gain is $2,200 (22% of $10,000).

As you can see, the tax owed on short-term capital gains can’t be calculated until the end of the tax year, when you can calculate your total income for the year. So you may want to plan conservatively and set aside a little extra for taxes in case you have a successful year of trading.

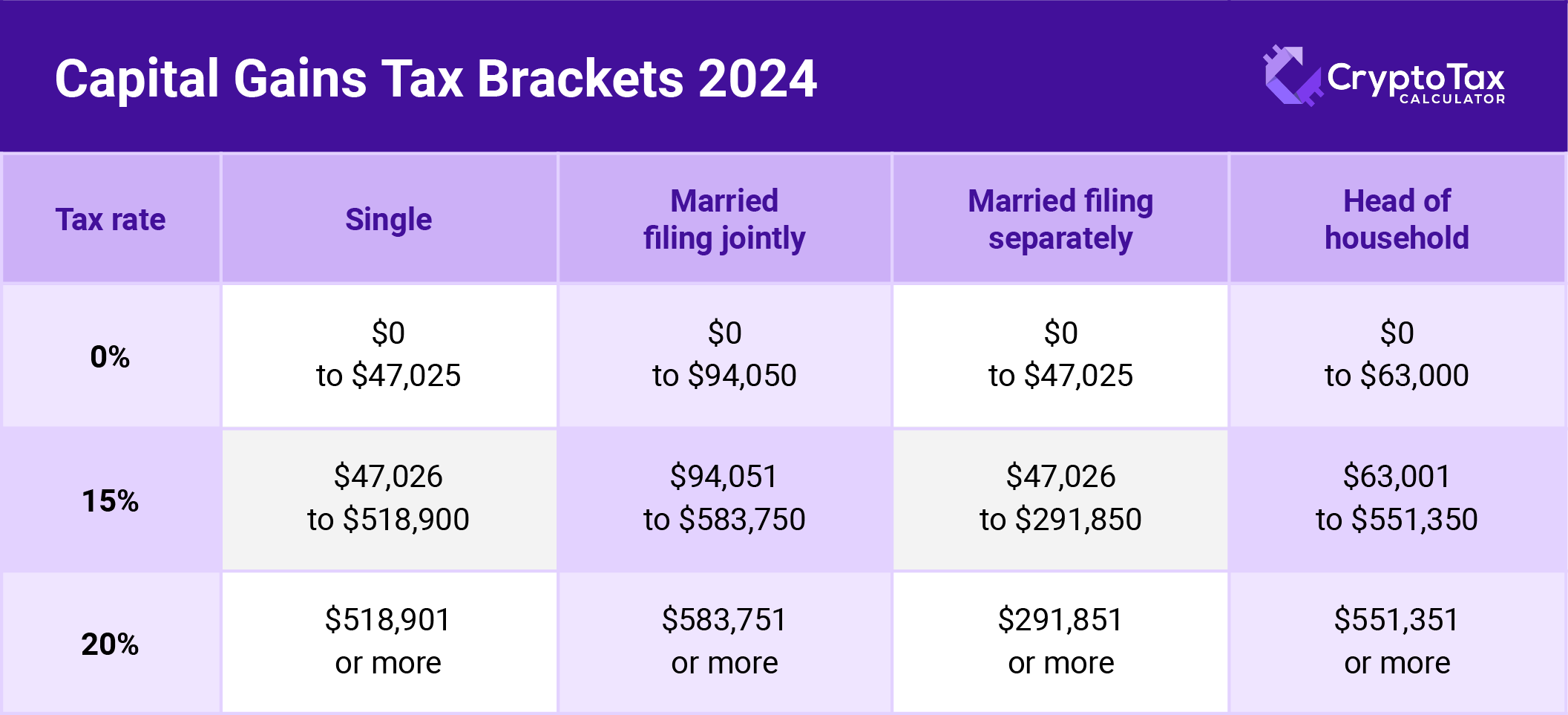

Long-term capital gains: If you have held cryptocurrency for more than a year

Cryptocurrency held for more than 1 year qualifies for long-term capital gains tax, which is generally more favorable.

Tax rates for long-term gains are 0%, 15%, or 20%, depending on your taxable income.

Holding cryptocurrency for at least one year before selling or exchanging it can significantly reduce your tax liability.

Capital gains tax brackets for the 2024 tax-year. These are what you use to calculate your tax when you lodge in 2025.

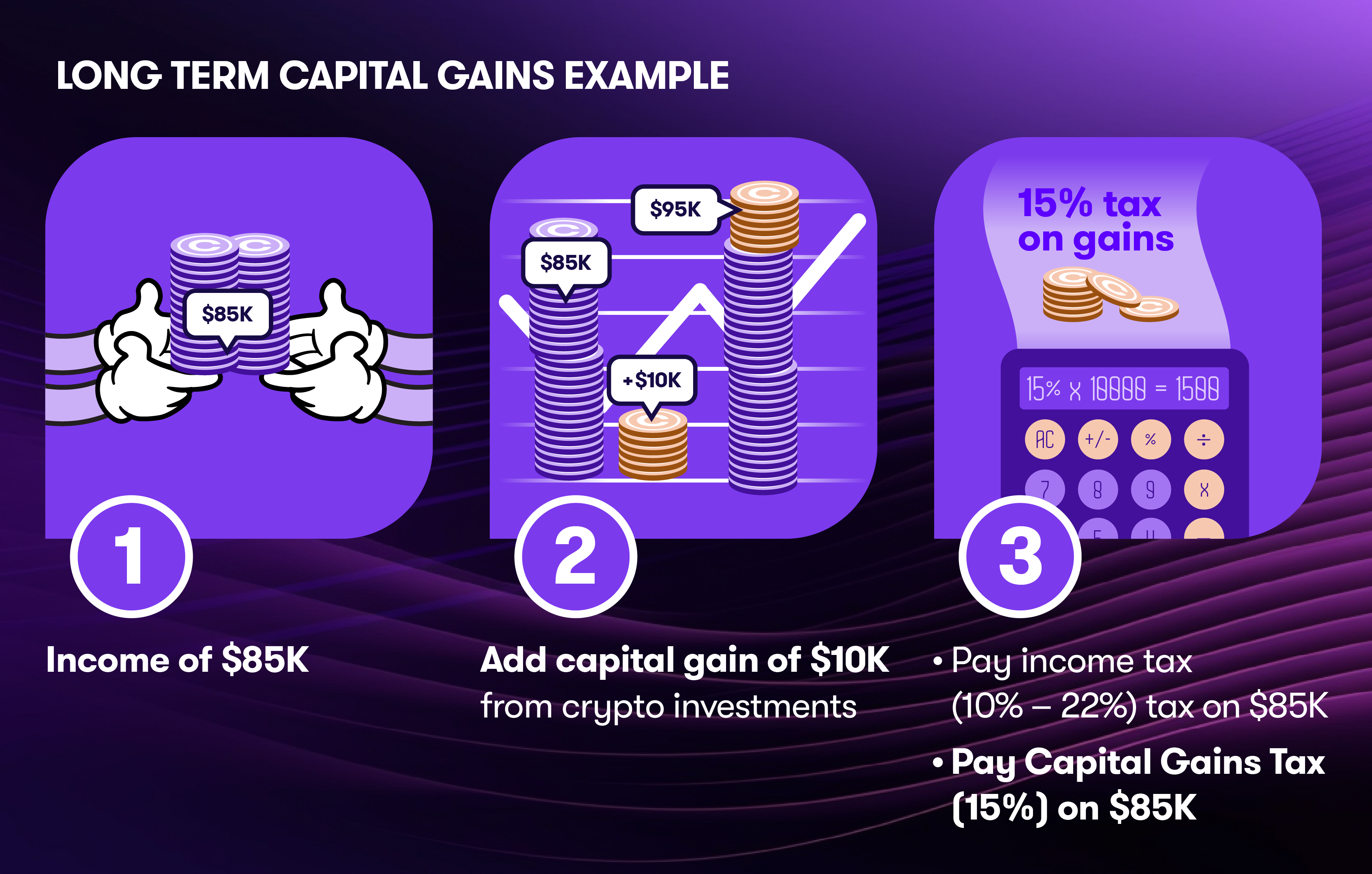

Example: Calculating tax on a long-term capital gain

In the earlier example, you sold your 1 BTC after 4 months for a $10,000 profit.

This meant your $10,000 profit was taxed at the federal income tax rate.

This implies a capital gain tax rate of 22% on your $10,000 profit, which saw you hand over $2,200 of those capital gains to the IRS*.

If you had instead sold that BTC for the same profit, 13 months later, then you would have only had to pay a 15% tax on the $10,000.

This is because that Bitcoin trade would qualify for the long-term capital gains tax rate, which based on your annual income of $85,000 would only be 15%.

So instead of paying $2200, you could have paid only $1500 in capital gains tax, a saving of $700.

With software like Crypto Tax Calculator, you can change your inventory method to First In First Out (FIFO) which helps optimize your tax report for long-term capital gains tax savings.

*Disclaimer: An important note about calculations

For the sake of comparison, we have simplified these tax calculations to show how short-term capital gains may be inefficient compared to long-term capital gains.

In reality your capital gain would be bundled in with your income tax and the total progressively taxed according to income tax brackets and thresholds

This means that your personal circumstances such as your yearly income and the size of the capital gain will greatly affect whether short-term or long-term capital gains are most tax efficient.

Let Crypto Tax Calculator do the hard work for you

1

Select country

2

Connect accounts

3

Get tax report

No credit card required

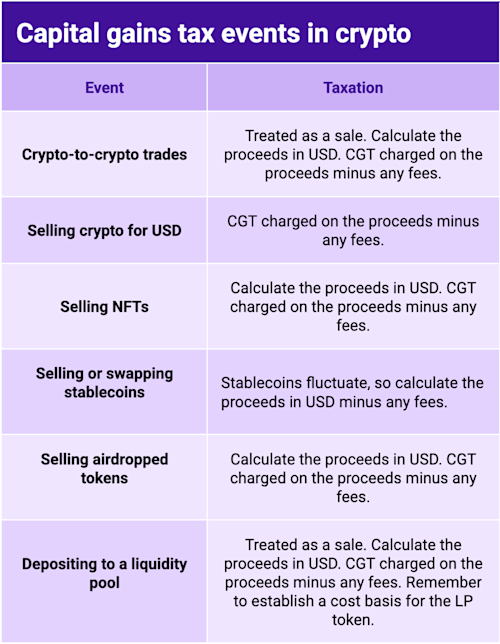

Capital gains tax events in crypto

Anytime that you dispose of a cryptocurrency, either at a profit or loss, a capital gains event is triggered.

Crypto-to-crypto trades (swaps)

Trading one cryptocurrency for another is considered a taxable event. Even if no fiat currency is involved, the IRS requires you to report any gains or losses from these transactions. This includes stablecoins.

Example:

Imagine you bought 1 Bitcoin (BTC) for $30,000. Later, you decide to trade your Bitcoin for 10 Ethereum (ETH) when the fair market value of 1 BTC is $40,000. Your capital gain is calculated as:

- Cost basis: $30,000 (the original purchase price of BTC)

- Fair market value at the time of trade: $40,000

- Capital gain: $40,000 - $30,000 = $10,000

- The new cost basis of your 10 ETH is $40,000

You need to report this $10,000 gain on your taxes, even though you didn't convert it to USD.

Selling crypto for USD (fiat)

When you sell cryptocurrency for fiat currency (eg, USD), you must report any capital gain or loss resulting from the sale.

Example: Suppose you purchased 2 Litecoin (LTC) for $100 each, totaling a $200 investment. A few months later, you sell them for $150 each, receiving $300 in total. Your capital gain is:

- Cost basis: $200

- Proceeds from sale: $300

- Capital gain: $300 - $200 = $100

This $100 gain is subject to capital gains tax and must be reported to the IRS.

Selling NFTs

Non-fungible tokens (NFTs) are unique digital assets, and selling them can trigger capital gains tax.

Example:

You minted an NFT artwork at a cost of $500 (including gas fees). A year later, you sell it for $2,000 worth of cryptocurrency. Your capital gain is:

- Cost basis: $500

- Proceeds from sale: $2,000

- Capital gain: $2,000 - $500 = $1,500

This $1,500 gain is taxable and should be reported.

Learn more in our dedicated NFT Tax Guide.

Selling Airdrops

Receiving an airdrop is considered other income, and selling those airdropped tokens can result in a capital gain or loss.

Example:

You received an airdrop of 1,000 tokens valued at $0.50 each, totaling $500 in income (which you should have reported when received). Six months later, you sell the tokens for $0.80 each, receiving $800. Your capital gain is:

- Cost basis: $500 (the amount you reported as income)

- Proceeds from sale: $800

- Capital gain: $800 - $500 = $300

Report this $300 gain on your taxes.

Learn more in our dedicated Airdrops Tax Guide.

Stablecoins

Stablecoins are cryptocurrencies pegged to underlying assets, typically fiat currencies like the US dollar.

Examples include Tether (USDT) and USD Coin (USDC), which aim to maintain a 1:1 ratio with the dollar.

Despite their intended price stability, stablecoins can experience slight fluctuations in value compared to the US dollar.

This means that buying, selling, or exchanging stablecoins can result in capital gains or losses, even if this amount is relatively small. This is because the IRS treats all cryptocurrencies, including stablecoins, as property.

Example:

You purchase 100,000 USDT at $1 each, totaling a cost basis of $100,000. Two months later, you sell all your USDT at $1.01 each, receiving proceeds of $101,000.

- Capital Gain: $101,000 (Proceeds) - $100,000 (Cost Basis) = $1,000 Gain

This $1,000 gain is subject to capital gains tax and must be reported on your tax return.

DeFi and liquidity pools

Engaging in Decentralized Finance (DeFi) activities, such as participating in liquidity pools, can trigger capital gains tax events.

This is because when you interact with DeFi protocols, you often exchange one cryptocurrency for another or for a token representing your stake, which the IRS may consider a taxable event.

Even if you don’t think this is a fair interpretation of the law, you still need to report your DeFi activity on your taxes.

If you’ve engaged with DeFi protocols this tax year, then we suggest that you consider using software like Crypto Tax Calculator which can accurately calculate your DeFi transactions for tax purposes.

Example

Suppose you provide liquidity by depositing 1 Ethereum (ETH) and 1,000 USD Coin (USDC) into a liquidity pool on a DeFi platform. In return, you receive liquidity pool (LP) tokens representing your share of the pool. If the value of your ETH and USDC has increased since you originally acquired them, you realize a capital gain at the time of the deposit.

Learn more in our dedicated DeFi Tax Guide.

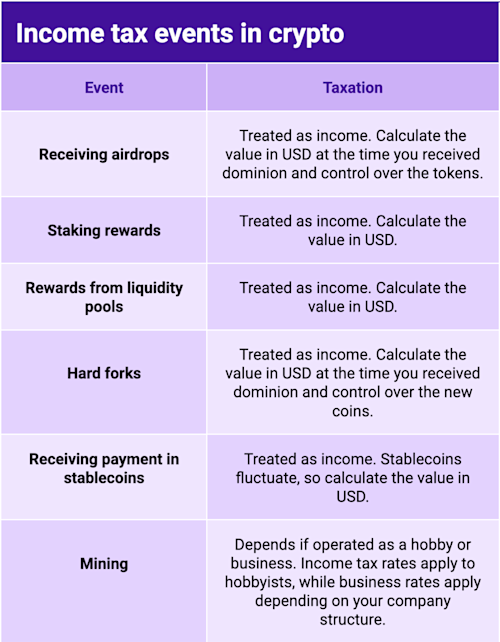

Income Tax events in crypto

In cryptocurrency, not all taxable events involve selling your assets.

Sometimes, simply receiving crypto can trigger an income tax obligation.

These events are taxed as other income because you're getting new coins or tokens as payment or rewards, not from disposing of assets you already own.

As a result, they need to be reported as income on your tax return.

Receiving airdrops

An airdrop is when you receive cryptocurrency for free, often as part of a promotional campaign or as a reward for performing certain on-chain actions. The IRS typically considers airdropped tokens as taxable income at their fair market value when you gain dominion and control over them.

Example:

You hold 1,000 tokens of Coin A. The developers airdrop 100 tokens of Coin B to you. On the day you receive them, Coin B is trading at $2 per token.

- Income to report: 100 tokens × $2 = $200

You need to include this $200 as other income on your tax return for the year.

If you later sell your airdrop rewards, you will recognize a taxable event and must report it as a capital gain or loss.

Learn more in our dedicated Airdrops Tax Guide.

Receiving staking rewards

Staking involves locking up your cryptocurrency to support network operations like validating transactions. In return, you earn additional coins. The IRS treats staking rewards as taxable income when you receive them.

Example:

You stake 500 tokens of Coin X and earn 50 tokens over the year. Each time you receive a reward, the token's market price is $1.

- Income to report: 50 tokens × $1 = $50

Report this $50 as other income on your tax return.

Rewards from liquidity pools

Providing liquidity to decentralized finance (DeFi) platforms often earns you rewards in the form of new tokens. These rewards are considered income at their market value when received.

Example:

You supply tokens to a liquidity pool and earn 10 tokens of Coin Y as a reward. At the time you receive each token, it's worth $5.

- Income to report: 10 tokens × $5 = $50

Include this $50 as other income for the tax year and report it on Schedule 1, line 8z

Hard forks

A hard fork occurs when a blockchain splits into two, creating a new cryptocurrency. If you receive new coins from a hard fork and have control over them, the IRS considers it taxable income.

Example:

You own 2 Bitcoins (BTC). A hard fork results in the creation of Bitcoin Cash (BCH), and you receive 2 BCH. When you gain control of them, BCH is valued at $300 per coin.

- Income to report: 2 BCH × $300 = $600

You must report this $600 as other income.

Receiving payment in stablecoins

Getting paid in cryptocurrency, including stablecoins like USD Coin (USDC), is treated as income. Stablecoins are pegged to fiat currencies but are still considered property by the IRS.

Example: You freelance and receive 1,000 USDC for your services. Each USDC is worth $1.

- Income to report: 1,000 USDC × $1 = $1,000

This $1,000 should be reported as ordinary income (rather than other income).

Mining

Mining as a hobby

If you are mining as an individual hobbyist, then any mined tokens you receive will be taxed according to your income bracket.

Mining as a business

However, if you are partaking in mining in the course of business or trade activities, your mined tokens will be taxed as business income, reported on various business forms depending on your business structure.

If you are a corporation, you will file using Form 1120; if an s-corp then Form 1120S, and a partnership then Form 1065. If you are conducting your business as a sole proprietor or a single member LLC, you will use Schedule C to report your income and expenses, but you will also be required to pay self-employment tax.

Note that businesses may qualify to deduct expenses associated with mining from their income.

Changes to crypto tax in 2025: Transitioning to wallet-based accounting

The IRS has introduced Notice 2025-7, which provides temporary relief for taxpayers regarding identifying digital assets held in the custody of a broker.

New accounting rules require taxpayers to switch from a universal or multi-wallet allocation method to an account-by-account identification method for all digital asset acquisitions and dispositions starting January 1, 2025.

However, recognizing that digital asset brokers and taxpayers may need time to adjust, the IRS has implemented a “safe harbour” relief period from January 1, 2025, to December 31, 2025, during which alternative identification methods may be used.

During this transition period, taxpayers may use alternative methods to adequately identify digital asset units, as long as they keep records showing how identification was done.

After December 31, 2025, taxpayers must comply with the wallet-by-wallet identification method as mandated by the IRS.

Key actions for U.S. Crypto Holders

Understandably, this all sounds rather confusing. So here’s what you need to do by December 31, 2025 in order to comply with the upcoming IRS requirements:

- Inventory all wallets and accounts. Identify all of your crypto wallets and exchange accounts. Make a record of these and keep them with your tax documents.

- Separate transactions by wallet. Categorize and record your transactions based on the specific wallet or account of origin or receipt.

- Track cost basis per wallet. Determine the cost basis for the assets in each wallet or account and add this to your records.

- Maintain accurate records. Record essential details for each transaction, including wallet address, date and time, transaction type, amount, cost basis, and fees.

- Adapt tax reporting methods. Ensure IRS forms (such as Form 8949) reflect wallet/account-specific gains and losses.

- Review past transactions and consult a tax professional if further help is required. Audit previous records to ensure accurate reporting and, if necessary, seek expert guidance on the correct inventory methods under the new IRS requirements.

Need help transitioning your accounts? Crypto Tax Calculator is here to help

We’re creating an automated migration that will shift your cost basis from a universal pool into individual wallet or exchange-level pools.

Crypto Tax Calculator will handle this process automatically if you’re currently using a universal cost basis so that you are fully compliant with the IRS’ new rules without lifting a finger.

Once we have migrated your accounting method to comply with the new rules, you will receive a report for each wallet or exchange that shows how your cost basis was assigned.

This ensures you have complete documentation to support your tax filings and demonstrate compliance.

If you don’t yet have an account with Crypto Tax Calculator, you can open one and easily switch to individual wallet/account-based reporting once you’ve imported your transaction history.

Read more about the transition for users here, or sign up now and let us do the hard work for you.

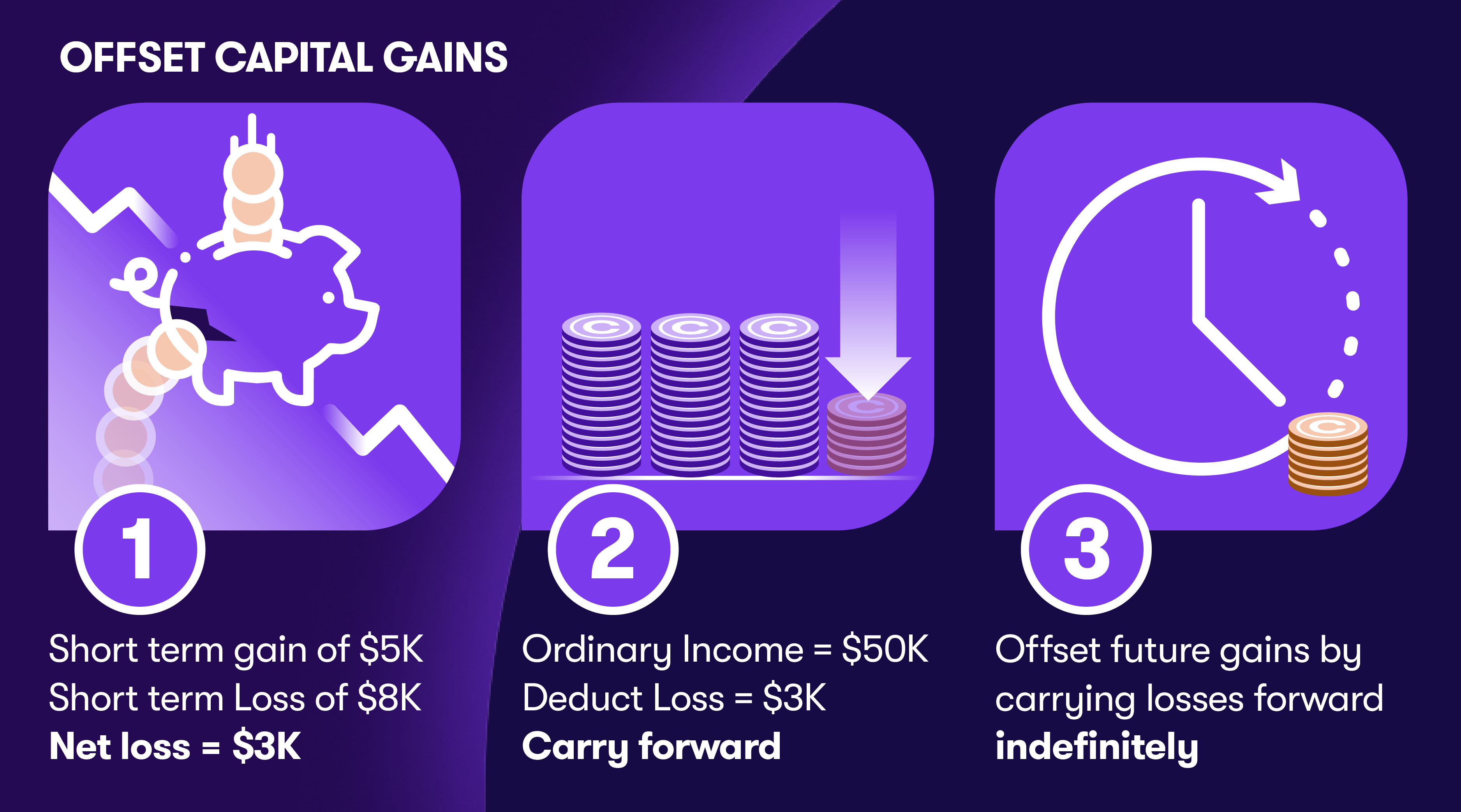

How to use crypto capital losses to offset income

By now you’re probably painfully aware that cryptocurrency trading involves losses, as well as gains.

Fortunately, you can use your capital losses to significantly reduce your tax liability.

And better yet, because the IRS treats cryptocurrency as property, your capital losses from cryptocurrency can offset gains from other assets – like stocks or bonds – not just your crypto.

Here's how it works according to the IRS:

Step 1 – Combine your gains and losses

First, offset losses against gains of the same type.

- Short-term losses offset short-term gains.

- Long-term losses offset long-term gains.

If losses exceed gains in one category, then you can apply the excess to the other.

For example, if short-term losses exceed your short-term gains, the remaining short-term loss can offset your long-term gains.

Step 2 – Offset your ordinary income

If your capital losses exceed your total capital gains, then you can deduct up to $3,000 ($1,500 if married and filing separately) from your ordinary income annually.

Any remaining losses can be carried forward indefinitely to offset gains in future years.

Example: Offsetting capital gains with losses

Suppose you have $5,000 in short-term capital gains and $8,000 in short-term crypto losses.

- First, offset the $5,000 gains with $5,000 of the losses, eliminating your taxable gain.

- The remaining $3,000 loss can then reduce your ordinary income.

- If losses exceeded this amount, the surplus would carry forward to subsequent tax years.

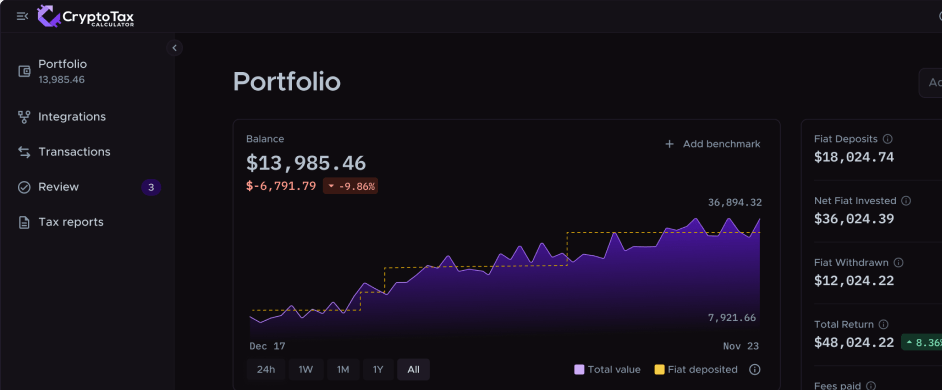

How to track all of your capital gains and losses for crypto

Calculating your capital gains or losses on cryptocurrency involves determining your cost basis (the original purchase price) and comparing it to the sale price or fair market value at the time of disposal.

The easiest way to do this is by using dedicated crypto tax software such as Crypto Tax Calculator which automatically categorizes your trades and calculates the associated gain or loss.

Using software also helps protect against human error, which could lead to an error in your reporting and trigger an audit.

However, if you’re set on doing it yourself then this is how to get started:

- Identify each transaction:

- Record every instance of buying, selling, trading, or using cryptocurrency.

- Include the date, amount, and price in U.S. dollars for each transaction.

- Calculate the gain or loss:

- Capital gain: Sale Price - Cost Basis (if the result is positive).

- Capital loss: Sale Price - Cost Basis (if the result is negative).

- Consider fair market value for trades:

- When exchanging one cryptocurrency for another, calculate gains or losses using the fair market value (FMV) of both assets at the time of the trade.

- Net Your Gains and Losses:

- Combine all short-term gains/losses and long-term gains/losses separately.

- Net short-term losses against short-term gains and long-term losses against long-term gains. If total losses exceed gains, you can use up to $3,000 per year to offset ordinary income, with the remainder carried forward to future years.

- Leverage Tools:

- Use crypto tax software or spreadsheets to simplify calculations, especially if you have numerous transactions.

- Download your trade history as a CSV from your exchange if they offer it.

Accurate record keeping is critical for compliance and minimizing your tax liability. Using crypto tax software and consulting a tax professional can help ensure you're reporting correctly and taking advantage of potential tax savings opportunities.

Track profit, loss and discover tax savings

No credit card required

Tax forms you may need for crypto

Filing your cryptocurrency taxes correctly involves using specific IRS forms. Here’s what you might need and where to report your crypto activities.

H3: Form 1099-MISC – Miscellaneous Information

If you earn income from crypto activities like staking rewards, referral bonuses, or airdrops, you might receive Form 1099-MISC.

- Where to report: Report this income on Schedule 1 (Form 1040), Line 8 as "Other Income." If the income is from self-employment activities, report it on Schedule C (Form 1040).

- Download Form 1099-MISC: https://www.irs.gov/pub/irs-pdf/f1099msc.pdf

- Instructions for Form 1099-MISC: https://www.irs.gov/pub/irs-pdf/i1099msc.pdf

H3: Form 1099-K – Payment Card and Third Party Network Transactions

Form 1099-K reports payment transactions from third-party networks. Form 1099-K rules are being phased in over two years, so there will be different reporting requirements for the 2024 and 2025 tax-years.

- 2024: The threshold for receiving a 1099-K is more than $5,000 in transactions.

- 2025: The threshold for receiving a 1099-K is more than $600 in transactions.

Make sure to apply the correct rules based on the reporting year.

- Where to report: Reconcile the amounts on Form 1099-K with your records. Report capital gains and losses on Form 8949 and Schedule D (Form 1040).

- Download Form 1099-K: https://www.irs.gov/pub/irs-pdf/f1099k.pdf

- Instructions for Form 1099-K: https://www.irs.gov/pub/irs-pdf/i1099k.pdf

H3: Form 1099-DA – Digital Asset Transactions

Form 1099-DA is a proposed form specifically for digital assets, aiming to streamline crypto tax reporting. 1099DA forms will capture gross proceeds for the year, starting in the 2025 tax year. The first 1099DA forms will be received by tax payers in 2026.

- Where to report: While this form is still under consideration, it may provide information to be reported on Form 8949 and Schedule D (Form 1040) in the future.

- Draft Form 1099-DA: https://www.irs.gov/pub/irs-dft/f1099da--dft.pdf

- Instructions for Draft Form 1099-DA: https://www.irs.gov/pub/irs-dft/i1099da--dft.pdf

How can I lower my crypto taxes?

Reducing your cryptocurrency tax liability legally can be done, but it involves strategic planning.

The methods discussed here need to be put into place before the end of the tax year to benefit from them that same tax year.

Inventory methods

Choosing an inventory accounting method affects your capital gains.

Two common methods are First-In, First-Out (FIFO) and Last-In, First-Out (LIFO).

FIFO

FIFO assumes that the first coins you purchased are the first ones you sell. It's straightforward and commonly used.

Example:

You bought 1 Bitcoin (BTC) at $20,000 in January and another 1 Bitcoin (BTC) at $30,000 in June. In December, you sell 1 Bitcoin (BTC) for $35,000.

- FIFO Cost basis: $20,000 (the price of the first BTC purchased).

- Capital gain: $35,000 - $20,000 = $15,000.

LIFO

LIFO assumes that the last coins you purchased are the first ones you sell. This method can reduce your taxable gains in a rising market.

Example:

Using LIFO, your cost basis is the last Bitcoin (BTC) purchased.

- LIFO Cost basis: $30,000 (the price of the last BTC purchased).

- Capital gain: $35,000 - $30,000 = $5,000.

By choosing LIFO, your taxable gain is lower, reducing your tax liability. Note that the IRS requires consistent use of the chosen method and proper documentation.

Specific Identification

Specific Identification is another method that allows you to select exactly which coins you're selling, giving you flexibility to minimize taxes.

To use Specific Identification, you must keep detailed records and be able to distinguish between different units of cryptocurrency.

Example:

- You have the following BTC purchases:

- 1 BTC at $20,000 in January.

- 1 BTC at $25,000 in March.

- 1 BTC at $30,000 in June.

- You choose to sell the BTC bought in March for $35,000.

Calculation:

- Cost basis (Specific ID): $25,000.

- Capital gain: $35,000 - $25,000 = $10,000 gain.

Tip: Crypto Tax Calculator offers several inventory methods, meaning you can see how your tax obligation will change at the click of a button.

Tax Loss Harvesting

This involves selling cryptocurrencies at a loss to offset capital gains.

Some investors will sell off their loss-making assets before the end of the tax year to reduce their overall tax liability.

Capital losses can offset capital gains dollar-for-dollar.

Example:

You have a $10,000 capital gain from selling Ethereum (ETH). You also hold some Cardano (ADA) that is currently at a $4,000 loss. By selling your ADA:

- Capital loss: $4,000.

- Net capital gain: $10,000 - $4,000 = $6,000.

Tip: If you import your portfolio into Crypto Tax Calculator, it will automatically identify assets that could be used for tax loss harvesting. It is particularly helpful if you have a large portfolio with lots of coins scattered across different exchanges and wallets.

Long-term Capital Gains

Holding your crypto for more than one year qualifies you for lower long-term capital gains tax rates.

By planning your trades to meet the one-year holding period, you can significantly reduce your taxes on crypto gains.

Example:

You bought 100 Chainlink (LINK) tokens at $10 each, totaling $1,000. After two years, you sell them for $30 each, receiving $3,000.

- Capital gain: $3,000 - $1,000 = $2,000.

- Tax rate: Depending on your income, the long-term capital gains tax rate could be 0%, 15%, or 20%, which is lower than the short-term rate (your ordinary income tax rate).

Hold Cryptocurrency in an IRA

Investing in crypto through a self-directed Individual Retirement Account (IRA) can offer tax advantages.

By holding crypto in an IRA, you can potentially delay or eliminate capital gains taxes on your crypto investments.

In 2024 and 2025 you can add up to $7000 to your self-directed IRA per year if you are under 50 years old, or $8000 per year if you are age 50 or older.

Example:

You contribute $6,000 to a crypto IRA and invest in BTC. Over time, your investment grows to $12,000.

- Traditional IRA: Taxes are deferred until you withdraw funds in retirement.

- Roth IRA: Contributions are made with after-tax dollars, but qualified withdrawals are tax-free.

Donating Cryptocurrency

Donating crypto to a qualified charitable organization can provide a tax deduction.

You will need a professional appraisal if the amount of cryptocurrency is over $5000.

Example:

You donate BTC worth $4,000 to a charity. You may deduct the fair market value of $4,000 from your taxable income, and you don't have to pay capital gains tax on the appreciated amount.

Gifting Cryptocurrency

You can gift up to $18,000 per recipient per year without incurring gift tax (as of 2023).

Example:

You gift $15,000 worth of BTC to a family member. This doesn't trigger any tax, and the recipient assumes your cost basis.

Exceptions to Tax Rules

Not all your transactions incur taxable events, and it is important to also be aware of non-taxable events so that you report crypto taxes only where it may be appropriate.

The following are typically seen as non-taxable transactions:

- Gifting crypto less than $18,000 to a single person within a given tax year, or $36,000 if you are married and filing jointly.

- Buying crypto with fiat money instead of other crypto (eg, purchasing BTC with USD instead of a stablecoin)

- Transferring crypto between different personally owned wallets/exchanges/accounts.

- Receiving a rebranded token (eg, from MATIC to POL)

- Staking crypto and withdrawing it (although you will need to pay tax on any rewards earned)

- Taking a crypto loan

- Putting crypto up as collateral

Keep in mind that your specific circumstances may affect whether or not these are taxable events, as well as the specific mechanics of any smart contracts you use (eg, lending via DeFi). Make sure to speak with an accountant if you are unsure.

Accurate recordkeeping is critical for compliance and minimizing your tax liability. Consider using professional crypto tax software like Crypto Tax Calculator to keep track of your transactions if you want to minimize your tax obligations.

Crypto Tax Calculator does the hard work for you

1

Select country

2

Connect accounts

3

Get tax report

No credit card required

Gray areas and misconceptions in crypto tax

Cryptocurrency is one of the newest and most rapidly evolving financial industries. As a result, tax law in the US has been relatively slow to catch up and there are still a lot of unknowns, misconceptions, or grey areas when attempting to apply existing laws to crypto.

Here are some notable gray areas in crypto that you should be aware of when reporting your taxes.

Lost or Stolen Crypto

The IRS hasn't provided clear guidance on how to handle digital assets that disappear due to hacks, scams, or lost private keys. This uncertainty leaves many taxpayers unsure of how to proceed.

Key considerations:

-

No explicit IRS policy: Currently, there's no specific IRS rule on claiming deductions for lost or stolen crypto assets.

-

Casualty and theft loss limitations: Under the Tax Cuts and Jobs Act of 2017, personal casualty and theft losses are only deductible if they're attributable to a federally declared disaster. This means you likely can't claim a deduction for lost or stolen crypto.

-

Potential capital loss: Some argue that lost or stolen crypto could be considered a disposal, potentially allowing for a capital loss claim. However, without clear IRS guidance, this approach carries risks.

What you can do:

-

Consult a tax professional: Given the complexities and lack of clear regulations, seek advice from a tax expert experienced in cryptocurrency.

-

Maintain thorough records: Document all details related to the loss or theft, including dates, amounts, and any correspondence. This information may be valuable if future legislation addresses this issue.

-

Stay informed: Keep an eye on IRS updates and potential changes in tax laws that might provide clarity on this matter.

Wash Sales

A wash sale occurs if you buy a stock or security that is identical to one you sold or traded at a loss 30 days prior.

For example, if you sold XYZ stock at a loss and repurchased it 27 days later, the trade would trigger a wash sale.

However, If you waited to repurchase ABC until 31 days after your first trade, a wash sale would not be triggered.

So the big question is does wash trading apply to cryptocurrency?

Cryptocurrency is not currently subject to the wash sale rule because the IRS classifies it as property, not a stock or security.

This means that you can sell your crypto at a loss and buy it back within 30 days and still record a capital loss.

Keep in mind you must also meet the IRS “economic substance doctrine”, which means that there must be an economic change for a transaction to have a reportable tax loss. So if you sell and immediately buy back, not letting any time or price fluctuation occur, then the IRS may say it lacks “economic substance” and disallow the loss.

There have been several efforts in US Congress to make cryptocurrency subject to the Wash-sale rule, which could negate this.

Rebase tokens

From a tax perspective, Rebase tokens are still an uncertain area with no specific guidance about whether rebase tokens may be taxed as income (similar to staking), or whether they only incur capital gains tax when disposed of.

Some people consider that rebasing can be parallel to a stock split, which would make it non-taxable. On the other hand, some people take the safer approach and report all of their rebase earnings as income based on fair market value at the time they were received. To ensure that you remain compliant, it is best to seek advice from a tax professional about your specific circumstances.

When do you need to report your crypto taxes?

You must report your cryptocurrency taxes by the annual tax filing deadline, typically April 15th.

If you file for an extension, the deadline to file is extended to October 15th, but any taxes owed are still due by April 15th.

Report all crypto income, gains, and losses on your Form 1040 tax return.

What if you forgot to report crypto on your taxes?

Failing to report cryptocurrency transactions can lead to penalties, interest, and potential legal issues.

Here's what could happen and what you can do to rectify the situation.

Consequences of not reporting crypto transactions

- IRS notices and audits: The IRS receives copies of Form 1099s from exchanges and can match them against your tax return. Discrepancies may trigger an audit or notices such as a CP2000 notice.

- Penalties and interest: You may face failure-to-pay and failure-to-file penalties, plus interest on any unpaid taxes.

- Legal repercussions: Willful tax evasion can lead to criminal charges, including fines and imprisonment.

Example

You forgot to report $5,000 in crypto gains. The IRS discovers this through third-party reporting. You could face:

- Late payment penalty: 0.5% of the unpaid tax per month, up to 25%.

- Interest: Charged on the unpaid tax amount, compounded daily.

Partial reporting due to complex portfolios

If you reported some but not all of your crypto transactions – perhaps due to assets scattered across DeFi platforms and various exchanges – the IRS might question the incomplete information.

Example:

You reported trades from your main exchange but omitted transactions from a decentralized exchange (DEX). The IRS cross-references Form 1099s and notices missing income.

How to correct any mistakes on your tax return

Proactively correcting your tax return can mitigate penalties if you come forward before the IRS contacts you.

- File an amended return: Use Form 1040-X to amend your previous tax return. Include the missed crypto income or gains.

- Gather records: Compile comprehensive records of all your crypto transactions, including wallet addresses, transaction IDs, dates, and amounts.

- Consult a tax professional: Seek advice to ensure you correctly report and minimize potential penalties.

Example:

Realizing you omitted $2,000 in staking rewards and $3,000 in DeFi gains, you:

- File Form 1040-X.

- Report additional income on Schedule 1 (Form 1040) and capital gains on Form 8949 and Schedule D.

- Pay any additional tax owed, plus interest.

Sources

- IRS Notice 2014-21: Guidance on Virtual Currency, Internal Revenue Service, 2014

- Frequently Asked Questions on Virtual Currency Transactions, Internal Revenue Service, 2021

- Revenue Ruling 2019-24, Internal Revenue Service, 2019

- About Form 8949: Sales and Other Dispositions of Capital Assets, Internal Revenue Service, 2022

- Instructions for Form 8949, Internal Revenue Service, 2022

- About Schedule D (Form 1040): Capital Gains and Losses, Internal Revenue Service, 2022

- About Form 1099-MISC: Miscellaneous Income, Internal Revenue Service, 2022

- Instructions for Form 1099-MISC, Internal Revenue Service, 2022

- Topic No. 409: Capital Gains and Losses, Internal Revenue Service, 2021

- Publication 544: Sales and Other Dispositions of Assets, Internal Revenue Service, 2021

- Publication 551: Basis of Assets, Internal Revenue Service, 2021

- IRS News Release IR-2018-71: IRS Reminds Taxpayers to Report Virtual Currency Transactions, Internal Revenue Service, 2018

- IRS Publication 550: Investment Income and Expenses, Internal Revenue Service, 2021

- 26 U.S. Code § 7701(o): Economic Substance Doctrine, U.S. Code, 2010

- Economic Substance Doctrine and Related Penalties, Internal Revenue Service, 2014

US Tax Guide

Unsure about your crypto tax obligations? This comprehensive guide helps you understand and file your crypto taxes in US.

Learn about US crypto taxes

DeFi Tax Guide

Have you been dabbling with DeFi? This in-depth guide breaks down the details of DeFi taxes in US so you can file with confidence.

Learn about DeFi taxes

NFT Tax Guide

Tried your hand at NFT trading? This complete guide that breaks down the details of NFT taxes in US so you can file with confidence.

Learn about NFT taxes